Sunshine Coast Property Market Update

- Written by Scene Magazine

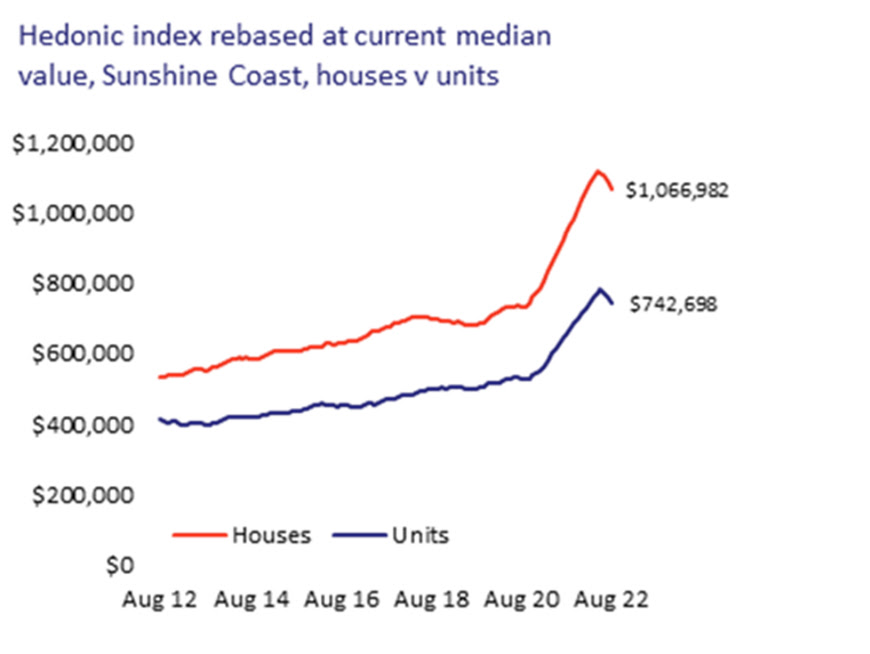

After a two-year boom, the Sunshine Coast has experienced a dramatic dip in property values. According to the experts at CoreLogic, there has been a 4.5% decline in the market since its peak just a few months ago.

The decline from July to August alone was as high as 2.2%. When compared to the rest of Australia, the Sunshine Coast has experienced the third largest regional drop and the second largest in Queensland. This is in stark contrast to the steep rises experienced at the beginning of 2020 through the spring of this year.

"For two years now, we have seen rapid growth in the local property market, and the shift from a pure seller's market into a more accessible market for buyers,” said Al Upton, from Sunshine Coast law firm, Butler McDermott.

Upton believes the change, coupled with uncertainty about interest rates, may mean a slowing of property transactions.

“But” he says, “the mass migration to the Sunshine Coast region has changed the market, possibly for the foreseeable future. Our conveyancing lawyers continue to be very, very busy."

COVID triggered spikes in home prices by over 50%, but with rising interest rates, rather than normalising the market, it has instead made prospective buyers more cautious. This tumble in house prices is expected to continue for several months but will depend on the interest rates.

We are in uncertain times, but interest rates are unlikely to peak until late 2022, or early 2023. Once these stabilise, the housing market will follow suit. That being said, incredible profits are still possible.

The Sunshine Coast experienced a massive boom on the back of the pandemic. The rapid drop in home prices on the Sunshine Coast was inevitable, and it now presents a unique opportunity for investors. It's a buyers’ market for now, and data from REA Group LTD shows there are plenty of hot spots across the Sunshine Coast that are ripe for the right investment.

Where Should You Look?

Peachester offers the best of both worlds – your home is in the mountains, but you have business facilities and beaches close by. It's clean, it's quiet, and it's green. You're just half an hour from all the Sunshine Coast's facilities and ten minutes from trains, buses, and markets. It has a low vacancy rate and a rental return of 3.7%.

Mountain Creek is a similar prospect, with river access, lakes, parklands, and bike paths. With a vacancy rate of just 0.3%, a 4.9% rental yield, and a median house price of $950,000, it's an excellent prospect.

Caloundra is a hot investment option that offers a relaxed coastal lifestyle with the additional benefit of parklands, and access to an advanced public transport network. With median house prices of $925,000 and a rental yield of 3.6%, it's an excellent option.

Coolum Beach has a slightly higher median house price of $1,300,000, but it is hot – think beaches and surfing, plus late-night markets, and fine dining. A popular spot for holidaymakers, it's a popular choice for investors. The vacancy rate is just 0.3%, and the yield is as high as 4% for units.

With so many hot market spots available, it remains a good time for investors to strike out, and the Sunshine Coast is the perfect place to do so.

Picture courtesy CoreLogic