House approvals continue to rise

- Written by HIA

“Market confidence in new home building has strengthened in recent months, as investors and owner occupiers return to the market,” stated HIA Chief Economist, Tim Reardon.

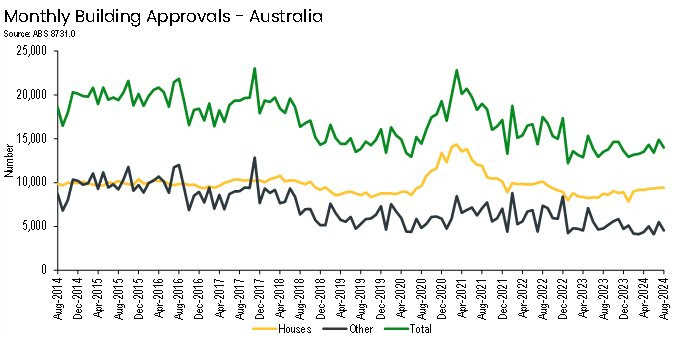

The Australian Bureau of Statistics today released its monthly building approvals data for August 2024 for detached houses and multi-units covering all states and territories.

“Detached house approvals rose by 0.6 per cent compared to July. House approvals in the three months to August 2024 were 11.2 per cent higher compared to the same time the previous year,” added Mr Reardon.

“The steady increase in detached house approvals is offsetting a low volume of multi-unit approvals and total dwelling approvals in the three months to August 2024 were 5.0 per cent higher compared to same time in the previous year.

“Rising tax imposts on foreign investors and rising regulatory costs are compounding the challenges for apartment builders.

“It has been almost eleven months since the last increase in the cash rate. Stable interest rate settings have provided the certainty needed to see a rise in home building confidence.

“This is complemented by stabilising price growth for building materials, a return to normal build times, strong housing demand and low unemployment.

“Detached house approvals in Perth and Brisbane are faring much better than in Sydney and Melbourne. Confidence in the Melbourne new home market has been adversely impacted by two new taxes.

“The Australian Government cannot tax its way out of achieving the agreed national target of 1.2 million new homes.

“Recent discussions on negative gearing and capital gains tax arrangements for residential property will undermine confidence in new home building.

“The government’s focus should be on lowering the taxes, regulatory costs and excessive charges that make up as much as 50 per cent of the final cost of a house and land package,” concluded Mr Reardon.

House approvals over the three months to August 2024 increased by 47.5 per cent in Western Australia compared to the same time in the previous year. This was followed by Queensland (+19.7 per cent), South Australia (+10.0 per cent) and Victoria (+8.4 per cent). The other jurisdictions recorded a decline over the same period, led by the Australian Capital Territory (-18.6 per cent), followed by Tasmania (-17.8 per cent), New South Wales (-7.6 per cent) and the Northern Territory (-6.8 per cent).